Financial services industry

Introduction

In general the term financial services industry encompasses a variety of organizations. Examples of financial service institutions are credit card companies, investment funds, asset management companies as well as banks and insurance companies which are the most obvious examples. This thesis has a particular focus on the banking industry. Nevertheless, many of the sources used as input for the creation of this thesis sum up banks and insurance companies as financial service companies and subsequently do not explicitly differentiate their findings. Hence, in this thesis the term financial services is used accordingly.

Financial service companies are not creating real products or distributing goods but rather deal with intangible products and services such as accounts and loans [HAC07]. Because these intangible products heavily depend on the use of IT systems, financial service companies are often recognized as technology leaders compared to other industries [KRU05]. This technology leadership also stands for early utilization of new information technologies [BLA08] which started as early as 1960. The early adoptions of IT-systems led to continuously growing IT-landscapes which are, at the time being, still affected by the early systems. In order to be able to consider the special characteristics of the IT-landscape in the financial service industry, a historical overview of IT in banks followed by the current situation is given in this chapter. Additionally, business aspects of IT in banking are mentioned.

Historical perspective on IT in banking

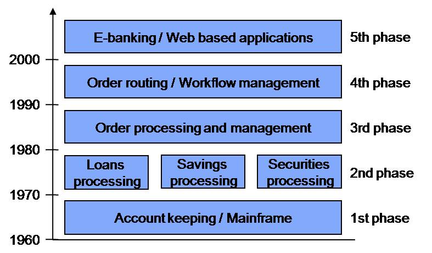

Banks have been one of the first operators of large and complex IT systems because of the huge amount of electronic processable data they have to deal with. Of course the information technology used varies considerably between different banks. Some kind of least common denominator can be identified because of the equal circumstance each bank faced, though [MOR98]. According to [MOR05a], five evolutionary steps which are caused by innovations can be distinguished. These steps are illustrated in [1].

Banking IT nowadays

In consequence of the long technological history in banks the IT is highly integrated and complex. Although IT is known to be a competitive factor in the banking industry, legacy systems still emboss large parts of the back-end layer and the high investments needed to replace them are in many cases avoided [GRU02][MOR05a]. A more detailed explanation is given here: phases

Current trends in the financial services industry

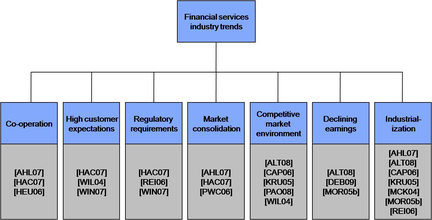

Many scientific and non-scientific sources mentioning different trends and challenges in the financial services industry from different points of view exist. However, these sources hardly consider the different challenges the industry is facing holistically. In order to provide an overview and retrieve the most important issues, a literature analysis on the publications used for the creation of this thesis was conducted. All mentioned trends for the financial services industry have been collected and a set of core trends was deduced.

These core trend categories are:

It is important to mention that the selected literature may not provide a comprehensive overview of all trends in the financial services industry. Additionally, most of the sources have been published before the financial crisis appeared in 2008, which leads to the assumption that declining earnings are now an even bigger issue. Recent information shows that financial institutions such as Deutsche Bank and UBS face a strong decline in earnings [DEB09].

Main objectives for a SOA adoption in the fiancial services industry

A cross-industry analysis shows that SOA’s economic potential in the financial services industry is comparatively high [AHL07]. That is mainly due to the superior role information systems play in the business models. Many of the main business processes are executed end-to-end solely by information systems. In other industries such as the manufacturing industry a considerable amount of the core processes involves manual interaction and therefore reduces the impact of SOA benefits [AHL07].

[BLA08] presents a survey conducted among leading IT employees in Germany’s largest 1001 banks. The key motivation was to show whether SOA is a major trend for the financial service industry. The survey proves that the most important goal when adopting a SOA is the reduction of costs. Other important goals identified in this survey are flexibility and agility, reduction of interfaces, increased innovation speed, and enhanced transparency in business processes. Optimization of straight through processing and easier outsourcing was rated with lower importance.

Flexibility, operational efficiency, and decoupling are expected to be the key SOA benefits for the financial services industry in [HOP06]. It is further mentioned that focusing only on reusability makes it unlikely that the considerable initial investments needed for a SOA in the financial sector will ever pay-off.

Status quo on SOA in the fiancial services industry

Various case studies describing the obstacles and benefits of ongoing SOA adoptions in the financial services industry exist. These case studies indicate that a number of financial institutions are currently facing the tough challenges that come with a SOA adoption. Examples are Credit Suisse [HEU06], Winterthur Group [KRA07], Halifax Bank of Scotland [KRA07], and Zuger Kantonalbank [REI06], to name just a few.

Up-to-date surveys which examine the level of SOA adoption in the financial services industry are scarce. Nevertheless, some non-academic surveys done in 2006 have been found [CAP06], [HOP06]. Both of them predict that the number of financial institutions adopting a SOA will increase.

A major academic survey amongst Germany’s largest 1001 banks done by the E-Finance Lab in 2008 [BLA08] gives more detailed insights. According to this survey, approximately one third of the German banking industry considers the whole SOA concept not interesting at all. Additional 12% do not consider a SOA implementation leading to a total of more than 44% which are currently showing no interest in adopting a SOA at all. The most important reasons for the missing interest in adopting a SOA mentioned by this group were the lack of experience in the field of SOA and organizational restrictions.

However, the large proportion of 25% is interested in implementing a SOA but has no concrete adoption plans yet, whereas about 15% are already planning their implementation. About 4% are currently in the course of SOA adoption. The remaining 12% claim that they have implemented a SOA already.

Under the assumption that these 12% still have not reached the highest level of SOA maturity, it can be deduced that the majority of the German banks (56%) represents the potential target group for a SOA Maturity Model like the SOA Maturity Model for the Financial Services Industry (SMF) developed in the course of this work.

Letzte Änderung: 11.05.2009, 18:08 | 1141 Worte