SOA Maturity Model for the Financial Services Industry

Introduction

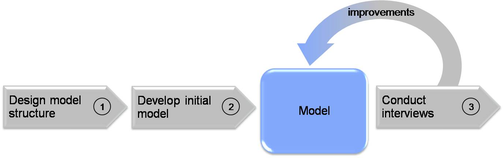

The process to develop the SOA Maturity Model for the Financial Services Industry is based on Design Science Research. Hence, the development of the model is iterative and consists of cycles which continuously improve and evaluate the model. This is done in three major steps which are also shown in [1].

First Step

Firstly, the structure of the model is developed. The objective is to create a flexible model structure which allows a systematization and logical grouping of maturity criteria but also satisfies the required expandability.

Second Step

Secondly, the initial version of the SMF is developed. The content is derived from existing maturity models as well as various academic resources such as case studies and literature, and assigned to the relevant parts of the model.

Third Step

Thirdly, interviews are conducted to get a praxis perspective on the issues that arise with a SOA adoption in the financial services industry. Additionally, the model is evaluated during the interviews. The outcomes of these interviews are improvements which are incorporated to build the final version of the SMF presented in this thesis.

Nevertheless, the final version in this document should not be seen as the final SMF version in general. Since SOA adoption in the financial services industry is not a static topic, the SMF should neither be a static model. Therefore, additional improvements and changes are welcome and also comply with the idea of Design Science Research [HEV04].

Letzte Änderung: 11.05.2009, 19:33 | 260 Worte